The Gupta Family Group Alliance (GFG) owns a collection of businesses in energy, steel and trading which spans the globe, employing around 35,000 people.

Its high-profile executive chairman Sanjeev Gupta has become famous for buying troubled steelworks and factories, promising to keep them open and save jobs.

He has been particularly active in the UK – starting his trading business, Liberty, from his room at Cambridge University.

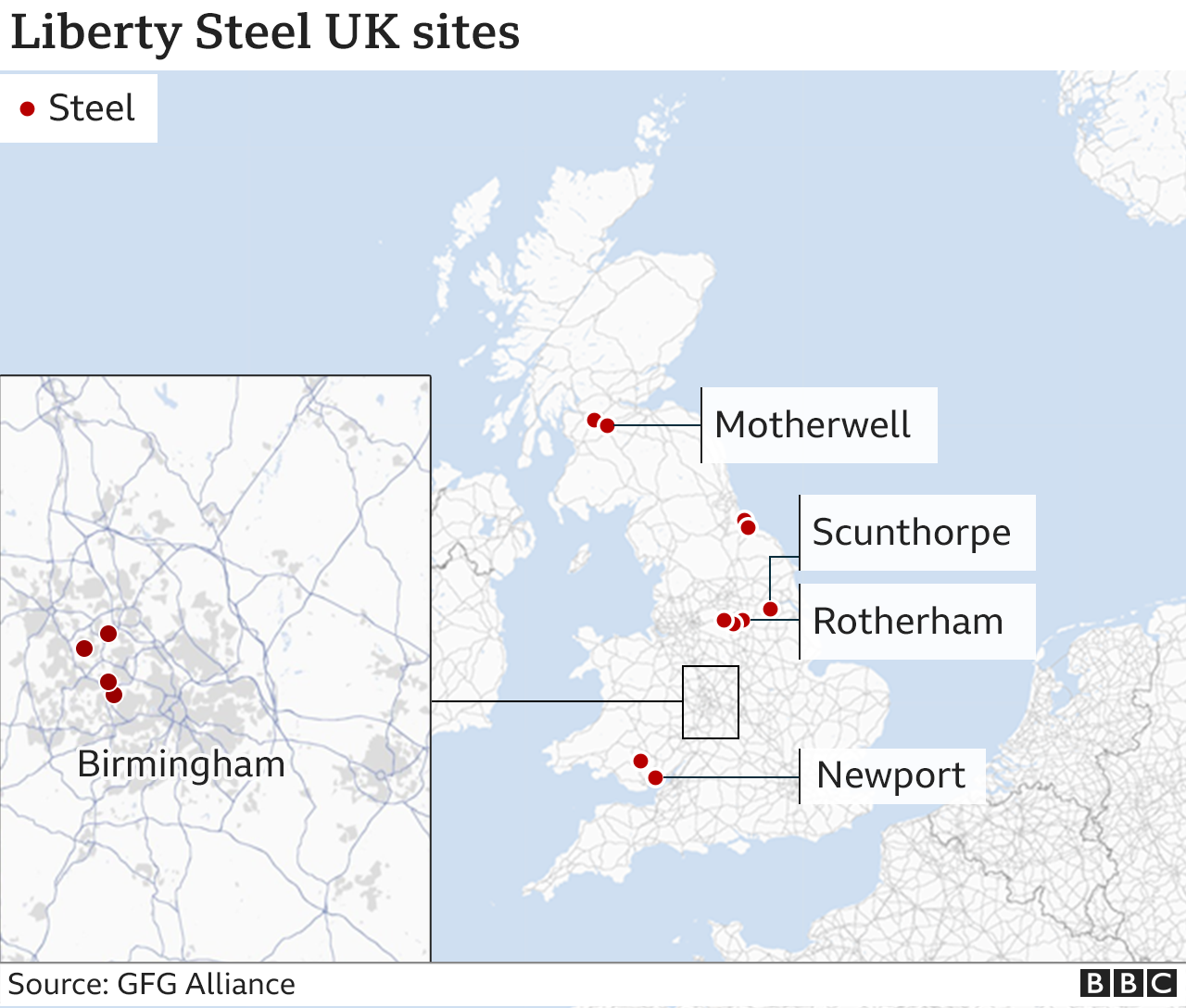

When steelworks in Yorkshire, Scotland and South Wales were put up for sale – and threatened with closure – GFG stepped in and bought them.

However, GFG’s main backer Greensill Capital collapsed in March, leaving the business scrambling for cash. A number of parts of the GFG empire are now being offered for sale to fill the hole in GFG’s finances.

And the future of many plants and their workers remains uncertain.

GFG’s steel business in the UK ranges from the 150-year-old Dalzell plant in Motherwell, to a rolled steel plant in Newport, South Wales, which took Mr Gupta two years to reopen.

The firm is selling two plants in South Yorkshire, at Stocksbridge and Brinsworth, and a third in West Bromwich, which makes speciality steel parts for the makers of planes and cars.

GFG owns another, larger steelworks in Rotherham, as well as a plant in Scunthorpe, and a number of smaller factories in the West Midlands, South Wales, Hartlepool and Teesside.

What else does GFG own?

GFG Alliance has 5,000 employees in the UK, employed in a range of industries from banking and manufacturing, to steel, aluminium and renewable energy.

The financial heart of the business is Liberty Commodities, which trades metals around the world, with a turnover of $6.4bn (£5.3bn).

It has trading offices in London, Dubai, Hong Kong, Shanghai and Singapore.

GFG also owned its own bank, Wyelands, named after Sanjeev Gupta’s £3m home in South Wales, though in May it announced that it would close down if it couldn’t find new investors.

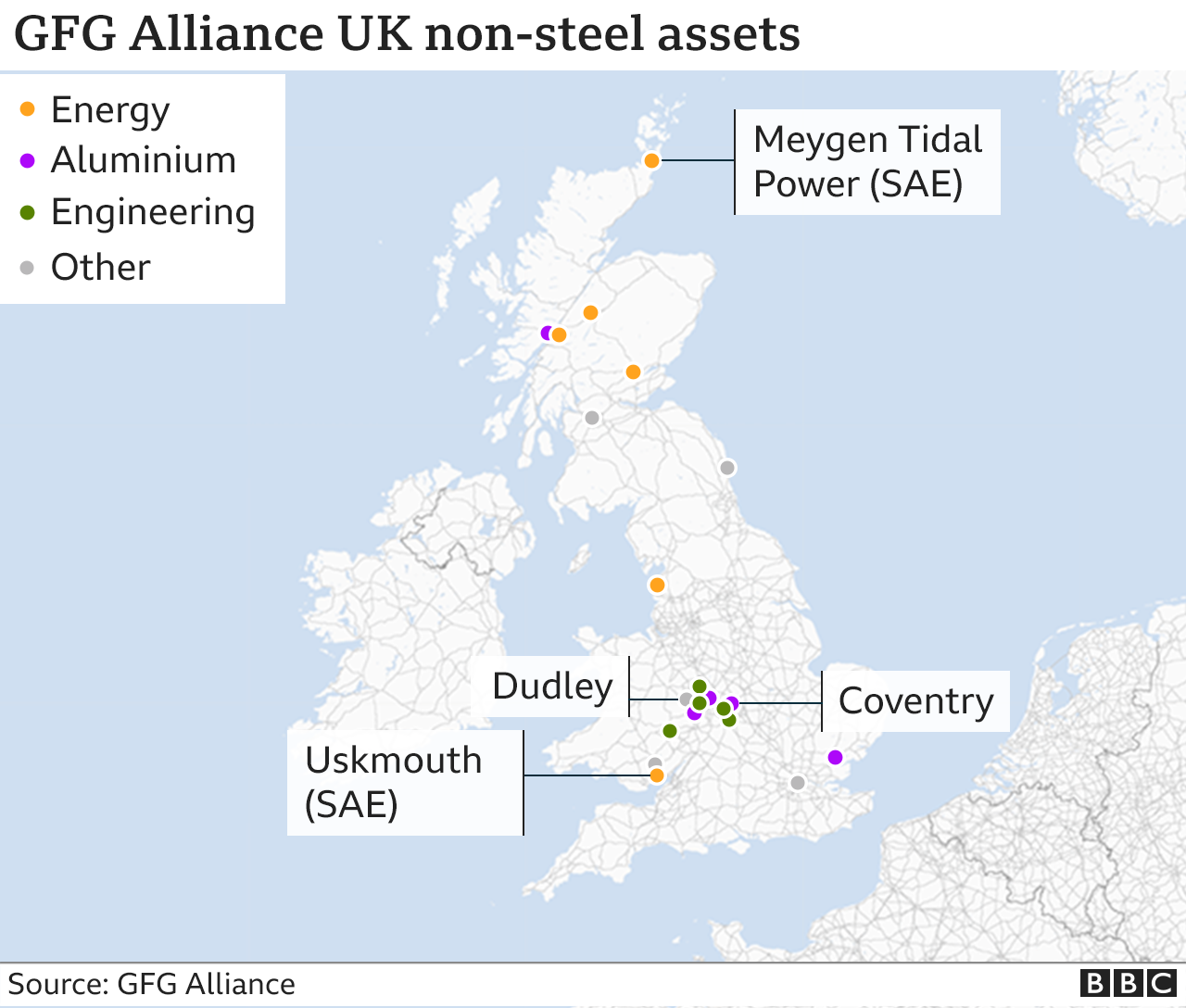

The firm owns the UK’s last aluminium smelter, in Fort William, Scotland, where bauxite ore is turned into eight-tonne bars of pure metal, ready to be made into finished products.

Smelting aluminium requires vast amounts of electricity, which is provided by a hydroelectric dam in the hills above the smelter.

The dam came with 114,000 acres of land, in the highlands around Ben Nevis and further east at Glenshero, where GFG is planning a 39-turbine wind farm.

Renewable energy projects like this are central to GFG’s vision of a more environmentally friendly approach to metal production, which can often be highly polluting.

Sanjeev Gupta has assembled a diverse collection of businesses around the world

Sanjeev Gupta has assembled a diverse collection of businesses around the worldOn top of this, GFG owns a 43% stake in SIMEC Atlantis Energy (SAE), which installed a turbine under the waters of the Pentland Firth, between John O’Groats and the Orkney Islands, to harness the power of the tide.

Next to the steel plant in Newport, South Wales, stands the Uskmouth power plant – originally coal – which SAE is converting to produce energy by burning fuel derived from rubbish.

As well as rescuing threatened steelworks, GFG has bought a number of engineering businesses, such as the century-old Covpress car parts factory in Coventry, which is now known as Liberty Pressing Solutions. It too is being sold.

Liberty is also selling its aluminium manufacturing business, with factories in Witham in Essex, as well as Wednesbury and Kidderminster in the West Midlands.

GFG’s acquisitions have left it with a large property portfolio, which it has been starting to develop.

In 2019 it sold a former factory site in West Bromwich to Persimmon Homes for £2.5m.

The firm has been developing plans to build 100 homes on another former factory site in Dudley, and a hotel next to the Clydebridge steelworks.

Read full article at BBC